John Mulligan, Director and climate change lead at the World Gold Council

The World Gold Council found its presence at COP26 in Glasgow to have been rewarding, not least as it allowed us to participate in a wide range of discussions with institutional investors of scale and hear how they were shifting their strategies and expectations in response to the climate crisis and policy environment. But other participants were less positive. And, even now, as the conference recedes in the rear-view mirror, there is a plethora of commentary and analysis evaluating its impacts and implications – asking, just how successful was it placing us on a road that might help curb global warming?

I have written elsewhere that these gatherings of the world’s governments are often, almost inevitably, disappointing. The compromises, fudges and deferrals

that some countries, and some sectors, may regard as a victory for rational pragmatism over activist zeal, typically result in a final collective agreement that is written in at least one too many shades of grey. What the world needs, of course, are blazingly bold black and white action plans, stated with ambition, accountability and integrity.

In contrast to vague commitments, the climate science – as articulated in overwhelming and incontrovertible detail in the recent Assessment Report from the International Panel on Climate Change (IPCC) – is blindingly clear. It signalled that this COP was supposed to be the last chance saloon; the final opportunity for policy makers to ensure they remained on the road to net zero in 2050, keeping alive the hope of a global climate increase limited to 1.5oC, as guided by the science. It is fair to say, however, that the last-minute agreement of UN parties, now known as the Glasgow Climate Pact, did not fully reflect the clarity and urgency of a world balanced precariously on a ‘tipping point’. The Economist summarised COP26 as ’not the stuff of triumph; but not a trainwreck, either.’¹ But, regardless of the many mixed messages, we are undoubtedly in a better place after Glasgow than we were before. The commitments from governments, while still insufficient, are clearer and more ambitious. We now have an agreed framework for a global carbon market. Intergovernmental pledges to tackle deforestation should be helpful in binding climate and biodiversity objectives. And the focus on methane emissions may rapidly translate into meaningful actions with immediate climate impacts.

As has often been the case in recent years when considering climate-related risks and impacts, the clearest signals and statements of intent in and around COP26 emerged from the investment and finance community. This was where we at the World Gold Council focused our attention and participation. We attended and spoke at a number of events in Glasgow where business and finance leaders were defining their plans and clarifying their strategies to contribute to emissions reduction and climate mitigation. At these events, we heard the major institutional investment groups – GFANZ, IIGCC, UNPRI, etc. – and specific climate-conscious investment leaders speak with what sounded remarkably like one voice. The determination of major asset owners and managers to adapt their portfolio strategies to reduce their exposure to climate risks, while also reallocating capital to better fund the transition to a net zero

carbon economy, was evident and unambiguous.

In practice, of course, things may not be that simple. For example, a recent analysis of the voting actions of the member organisations of the Net-Zero Asset Owner Alliance – a group of investment institutions committed to specific climate objectives representing around $10trn (£7.5trn) of AUM – has highlighted an uncertain pattern of commitment and action, concluding that “membership of net-zero alliances doesn’t mean leadership in acting on climate”². However, this does not necessarily indicate equivocation or hypocrisy. Rather, it may reflect how far we have come so quickly and how far we need to go, even more quickly, to transform our economy, and our investment decisions and holdings.

This is a perspective that we are familiar with at the World Gold Council; that is, we have come to recognise the need to re-evaluate strategies and methodologies according to a different or expanded set of risks and objectives. We have, over many years, established a substantial body of

research examining gold’s ability to enhance the risk-return balance in diversified portfolios. But, more recently, we have widened our focus to include consideration of how climate risks and impacts might affect these portfolios and gold’s role and performance within them.

Our analysis, undertaken in collaboration with third party research agencies, suggest that gold’s more traditional roles as a ‘safe haven’ asset and relatively stable store of value may be overlayed or reinforced in the context of climate-related economic and asset performance. Against a likely backdrop of amplified market risks and volatility, from escalating climate impacts on particular sectors or the market friction and disruption that may be imposed by a less than orderly transition, there may be heightened demand for a stable store of value with minimal direct emissions.

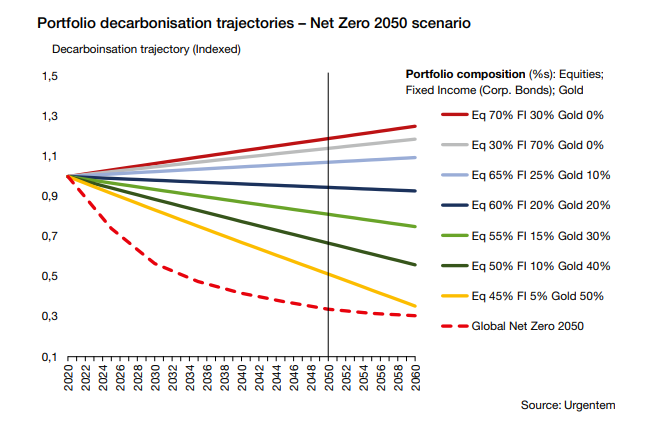

More specifically, we have recently explored (with finance climate risk analysts at Urgentem) how gold might contribute to the reduced carbon footprint of

equity and bond portfolios, and importantly, how it might assist in aligning portfolios to key climate targets. This builds on our earlier works to quantify

gold’s emissions across the supply chain and to map out, in a detailed and granular fashion, its opportunity to decarbonise.

In the lead-up to COP26, the primary focus was, understandably, on the ‘race to zero’ and corporate expressions of commitment to achieving net zero carbon by 2050. But, over the two weeks in Glasgow, we witnessed a clear shift in investor priorities and expectations regarding decarbonisation prospects and actions. One of the lessons learnt from our recent engagement is the weight now given to near-term actions and emissions reduction milestones over the next decade. Commitments may be a useful signal of intention, but swift actions, resulting in demonstrable and measurable change, are now the priority for many investors.

Compared to many other industries, gold is in a relatively positive position with regards its potential pathway to net zero. Decarbonising gold is all about how gold mining changes its power sources – how it consumes and generates electricity – and it is, therefore, very much aligned with the needs of the global economy.

In some contexts, however, gold will be key actor in supporting and accelerating the changes needed to decouple economic growth from its centuries-old dependency on fossil fuels. There are already notable examples of relatively remote locations, from Northern Canada to Burkina Faso and the DRC, where gold mining has been the main catalyst in bringing clean energy to local economies and communities.

One of the weaknesses of COP26 was, perhaps, that it did not adequately address the concerns of vulnerable nations – particularly, those lacking the resources to maintain socio-economic growth while, concurrently, building the capacity to implement adaptation and resilience plans. Calls for greater clarity on how decarbonisation and protection is facilitated and funded in poorer locations will probably get louder and more frequent as we move towards to COP27. The event’s Egyptian hosts have already signalled that more space and priority will likely be given to the voices of ‘frontier’ and developing economies.

While, for many investors, how gold is mined may be a long way from their immediate concerns. And those considering or invested in bullion and bullion-backed products (such as ETF/ETPs) would also be right in assuming there are few direct carbon or climate impacts

linked to these assets. But looking back on our discussions in Glasgow and looking forward to further conversations in Sharm el-Sheikh, and all those in between, it may surprise many investors how relevant gold might be in supporting resilient portfolio strategies and sectoral decarbonisation with ‘real economy’ impacts. It can – and often does – make a difference.

1) https://www.economist.com/international/2021/11/11/what-happened-at-cop26

2) https://www.bloomberg.com/news/newsletters/2021-12-08/climate-alliance-fall-short-on-shareholder-votes-green-insight